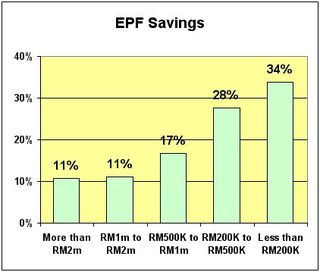

Earlier this yeatr, I was running a poll to ask job seekers to estimate how much they could accumulate in their Employees Provident Fund (EPF) by the time they retire. The EPF is a statutory body in Malaysia which collects monthly contributions from both employers and employees, and an employee can only withdraw from his account under special recognised circumstances. Normally, when a person retires, he should be able to withdraw the whole lump sum in his account. The results of this poll indicated that a vast majority of employees only have a vague idea of their accumulated savings. About a third of the respondents believed that they would have less than RM200,000 in their EPF Account, while about 28 percent said that their saivings would be between RM200,000 and RM500,000. Another 17 percent thought that their accumulated savings would be between half-a-million to one million ringgit, while only 22 percent firmly believed that they could get at least RM1 million from their savings.

The results of this poll indicated that a vast majority of employees only have a vague idea of their accumulated savings. About a third of the respondents believed that they would have less than RM200,000 in their EPF Account, while about 28 percent said that their saivings would be between RM200,000 and RM500,000. Another 17 percent thought that their accumulated savings would be between half-a-million to one million ringgit, while only 22 percent firmly believed that they could get at least RM1 million from their savings.

Considering that an average person would be working between 30 and 40 years during his lifetime, an accumulation of RM200,000 or less would be a gross underestimation. Just check for yourself: take your present annual salary, work out what’s 20 percent of it (consisting of both employer and employee contributions) and multiply by 30 years. it’s already a healthy sum and this does not even consider your annual increments and the interest that is compounded on the savings.