Apart from estate administration services, two of Rockwills Trustee Berhad’s most popular products are the UDeclare and UProtect. Both are based on a person (the settlor) drawing up a Trust Deed.

The UDeclare is simply a declaration to set up a Trust with the settlor as the Trustee and Rockwills Trustee as the substitute, which would mean that when the settlor passes away, the trust corporation will assume the role of trustee for the settlor’s trust assets.

Similarly, the UProtect is an insurance trust set up when the settlor absolutely assigns his life policies to the Trust. By specifying the distribution details in the Trust, the settlor has absolute freedom to decide how he wants to give his insurance moneys away eventually. In my opinion, this should be a highly popular product.

When I was looking over the old Rockwills brochures in my possession, I came across one which was promoting this very product. Here is a scanned image of the brochure and below it, I’ve reproduced its contents without the two diagrams. The writing style is a bit quaint at certain parts but the article is fully understandable. Do take a read.

And if you have questions on these two products that require answers, please do email me at ssquah@yahoo.com

If you think that you have done enough in providing security to your loved ones by nominating them as your beneficiaries in your insurance policies, think again.

You may want to think about creating a Trust on the insurance policy, especially when you have minors involved. Trusts have become an extremely effective Estate planning tool to protect assets and pass wealth to heirs while maintaining maximum privacy.

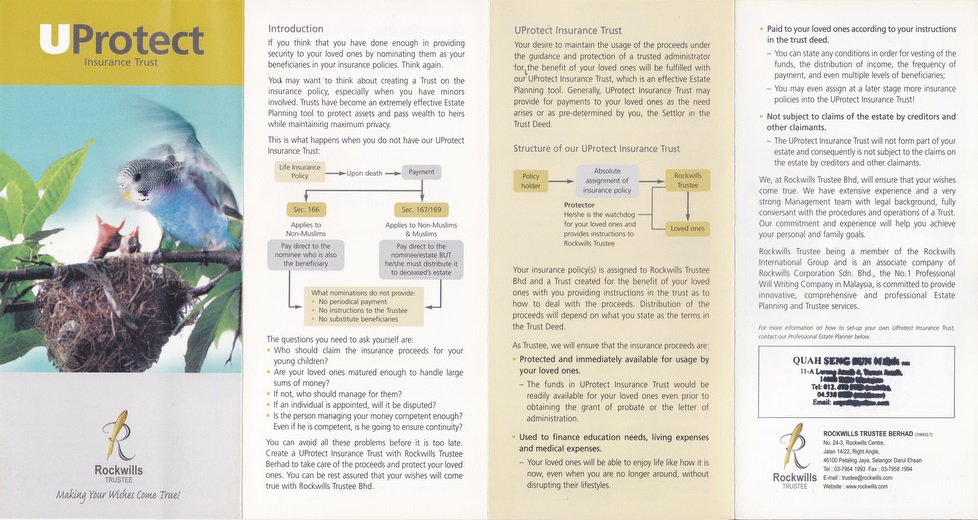

This is what happens when you do not have our UProtect Insurance Trust:

The questions you need to ask yourself are:

- Who should claim the insurance proceeds for your young children?

- Are your loved ones matured enough to handle large sums of money?

- If not, who should manage for them?

- If an individual is appointed, will it be disputed?

- Is the person managing your money competent enough? Even if he is competent, is he going to ensure continuity?

You can avoid all these problems before it is too late. Create a UProtect Insurance Trust with Rockwills Trustee Berhad to take care of the proceeds and protect your loved ones. You can be rest assured that your wishes will come true with Rockwills Trustee Bhd.

UProtect Insurance Trust

Your desire to maintain the usage of the proceeds under the guidance and protection of a trusted administrator for the benefit of your loved ones will be fulfilled with our UProtect Insurance Trust, which is an effective Estate Planning tool. Generally, UProtect Insurance Trust may provide for payments to your loved ones as the need arises or as pre-determined by you, the Settlor in the Trust Deed.

Structure of our UProtect Insurance Trust

Your insurance policy(s) is assigned to Rockwills Trustee Berhad and a Trust created for the benefit of your loved ones with you providing instructions in the trust as to how to deal with the proceeds. Distribution of the proceeds will depend on what you state as the terms in the Trust Deed.

As Trustee, we will ensure that the insurance proceeds are:

- Protected and immediately available for usage by your loved ones. The funds in UProtect Insurance Trust would be readily available for your loved ones even prior to obtaining the grant of probate or the letter of administration.

- Used to finance education needs, living expenses and medical expenses. Your loved ones will be able to enjoy life like how it is now, even when you are no longer around, without disrupting their lifestyles.

- Paid to your loved ones according to your instructions in the trust deed. You can state any conditions in order for vesting of the funds, the distribution of income, the frequency of payment, and even multiple levels of beneficiaries; you may even assign at a later stage more insurance policies into the UProtect Insurance Trust!

- Not subject to claims of the estate by creditors and other claimants. The UProtect Insurance Trust will not form part of your estate and consequently is not subject to the claims on the estate by creditors and other claimants.

We, at Rockwills Trustee Bhd, will ensure that your wishes come true. We have extensive experience and a very strong Management team with legal background, fully conversant with the procedures and operations of a Trust. Our commitment and experience will help you achieve your personal and family goals.

Rockwills Trustee being a member of the Rockwills International Group and is an associate company of Rockwills Corporation Sdn. Bhd., the No.1 Professional Will Writing Company in Malaysia, is committed to provide innovative, comprehensive and professional Estate Planning and Trustee services.